Signs of Overheating in the AI-Driven Economy

A growing chorus of financial institutions and global regulators, including the Bank of England and the International Monetary Fund, are issuing stark warnings that the current boom in AI investments may be entering dangerous territory. The valuation surge seen across AI and tech stocks, they argue, is increasingly untethered from real economic fundamentals, raising the specter of a dramatic market correction should investor confidence waver.

The Bank of England, in its recent financial stability report, pointed to a high concentration of market value in a small cluster of AI-heavy companies—particularly in the United States—warning that if expectations around artificial intelligence’s impact falter, it could unleash systemic shocks across financial markets. These AI firms are now so deeply embedded in equity indices and ETFs that a decline in just a few names could ripple across the global economy.

What’s more, the BoE emphasized the structural vulnerabilities underpinning AI: reliance on narrow compute supply chains, limited energy and data availability, and the tight coupling between model development and infrastructure bottlenecks. Any disruption in these foundational systems, they noted, could rapidly erode investor assumptions and valuations.

IMF Echoes Warnings: Enthusiasm Outpaces Returns

Kristalina Georgieva, Managing Director of the IMF, echoed the BoE’s sentiments, warning that while the long-term promise of AI is undeniable, markets may be overpricing short-term gains. Speaking at a financial governance summit, Georgieva noted that stock prices in many tech sectors have surged on projected AI productivity boosts—projections that are not yet fully supported by empirical returns.

The IMF emphasized that AI’s transformative potential is contingent on effective deployment, cultural adaptation, and business model innovation—none of which are guaranteed. In their view, the optimism fueling current valuations may be running ahead of the measurable impact AI has had on growth, efficiency, or labor outcomes.

Underlying their concern is the observation that much of the present AI investment cycle has been driven by speculative enthusiasm rather than tangible profit. Startups in generative AI, enterprise AI tooling, and consumer AI assistants are raising massive rounds at multibillion-dollar valuations, despite little to no revenue or user retention metrics to support them.

Poor ROI and Circular Financing Undermine Investor Confidence

Several reports now suggest that many generative AI initiatives have failed to deliver significant returns. An internal study referenced by regulators estimates that up to 95% of organizations piloting AI technologies have yet to see measurable ROI. This echoes findings from Gartner and McKinsey suggesting that while experimentation is high, true enterprise integration remains shallow.

Compounding the issue is the rise of what some analysts are calling “circular financing” structures—deals where AI startups raise capital to buy compute from hardware vendors who in turn invest in the very same AI firms. While legal, these arrangements risk creating inflated financial feedback loops similar to vendor financing schemes seen during the dot-com bubble. Rather than signaling sustainable demand, they may reflect capital being recirculated within a closed ecosystem that thrives on hype, not utility.

As speculative capital continues to pour into the AI space, many experts are drawing comparisons to the early 2000s, when internet companies with no profits or products secured lofty valuations on the back of buzzword-driven optimism. Today’s AI rush—while more technically grounded—carries eerily similar financial dynamics.

Risk Concentration and Exposure: The “Too Few to Fail” Problem

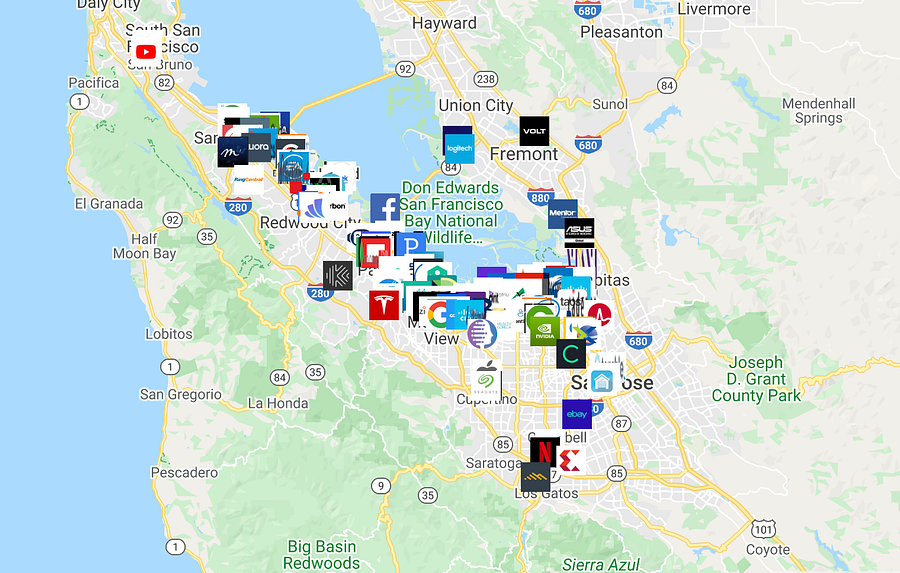

One of the most pressing concerns raised by regulators is the growing concentration of risk in a handful of tech giants. The likes of Nvidia, Microsoft, Alphabet, and Meta now dominate AI infrastructure, model development, and deployment platforms. Their share prices are buoyed not just by direct AI revenue but also by expectations that they will control and profit from the next industrial revolution.

This extreme exposure introduces fragility. A single disappointing earnings report, product delay, or regulatory shock affecting just one of these firms could trigger cascading losses across portfolios, indices, and retirement funds globally. The more the AI economy centralizes, the more its risks mirror those seen in systemically important financial institutions—making regulation and diversification increasingly urgent.

Infrastructure Bottlenecks and Hidden Dependencies

Another source of fragility lies in the underappreciated dependencies of AI’s infrastructure layer. High-end AI systems require enormous energy, rare earth materials, high-bandwidth data centers, and specialized chips—all of which are limited in global supply. As multiple nations scramble to onshore compute and assert sovereignty, the geopolitical risk around AI infrastructure continues to escalate.

The Bank of England specifically called out power constraints, latency sensitivity, and logistics complexity as material risks. If even a portion of AI companies face delays in acquiring the infrastructure they need—whether due to chip shortages, export restrictions, or energy rationing—it could trigger downward reassessments of their growth trajectories, valuations, and funding prospects.

Not All Agree: Is There Really a Bubble?

Despite growing alarm, not everyone in the financial community sees an imminent threat. Mary Daly, President of the Federal Reserve Bank of San Francisco, stated in a recent interview that while tech valuations are elevated, the underlying fundamentals of many AI firms remain strong. She argued that productivity potential, robust demand, and strong balance sheets differentiate this moment from past bubbles.

Others suggest that even if a correction comes, it could be healthy—shedding speculative players, reallocating capital toward more viable use cases, and bringing valuations in line with long-term value. In this view, a short-term pullback might not indicate a crisis, but a natural market adjustment.

Still, the concern remains that investor psychology, once shaken, can overcorrect. If hype-fueled expectations are proven premature, and institutional investors begin rotating out of AI-heavy equities, it could trigger a broader downturn not just in AI, but in the wider tech sector.

A New Phase for AI: From Hype to Accountability

As generative AI matures and regulation looms, the financial environment around the industry is entering a new phase. Gone are the days of unchecked optimism and blank-check funding. Investors, founders, and policymakers must now confront hard questions: Where is the real value in AI? Which firms are delivering impact, not just demos? And how can the market prevent a repeat of past bubbles without stifling innovation?

These questions will shape the next chapter of AI’s economic journey. Whether that journey leads to sustainable transformation or a sobering correction will depend not just on technology, but on financial discipline, governance, and transparency.